2025 Guide to Singapore GST: Registration, Filing & Essential Tips

Many business owners told us that GST in Singapore is an administrative headache. It's complicated, time-consuming, and nerve-wracking. One small mistake could cost businesses thousands of dollars.

Some business owners are also uncertain about when and which Singapore GST applies to their business. Don't worry, as we'll explain how this whole tax system works.

We'll cover the following in this article...

- What is the Goods and Services Tax (GST)?

- How Does GST Work in Singapore?

- Do You Need to Register for GST in Singapore?

- How Do You Register for GST in Singapore?

- What Happens After You Register for GST?

- How Is GST Applied? What Kinds of Products and Services Are Subject to GST?

- How to File GST Return

- Should Your Business Register for GST Voluntarily?

- Different GST Incentive Schemes

- Piloto Asia's Accounting Services in Singapore

What is the Goods and Services Tax (GST) in Singapore?

GST is a consumption tax added to the price of goods and services in Singapore. It means that when you buy something, the business adds it to your bill.

The business collects the tax from every sale then pays it to IRAS on a monthly or quarterly basis.

As of 2025, the Singapore GST rate is 9%.

At this point, you may be wondering:

Does every company need to charge the customers GST on the goods/services? (In other words, does every Singapore company need to register for GST?)

Is GST applied to every good or service regardless of where it is sold?

The answer is NO.

Don't worry; we will explain everything in detail below.

How Does GST Work in Singapore?

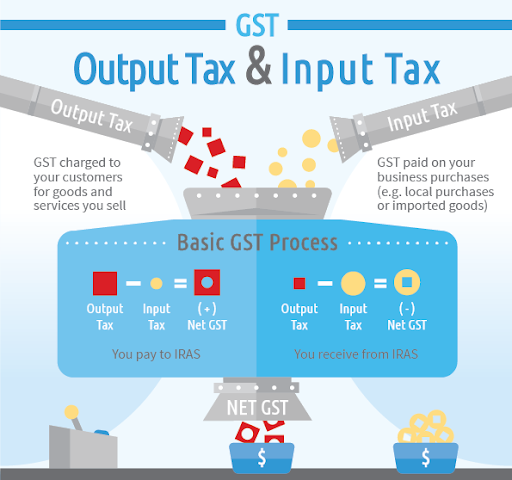

The following infographic provides a good summary of how the GST system works in Singapore.

Photo Credit: Inland Revenue Authority of Singapore (IRAS)

As you can see, the system works in two ways for GST-registered businesses in Singapore:

You charge GST (i.e. Output tax), and

You pay GST (i.e. Input tax)

You read that right. Business owners will also need to pay GST. If you haven't noticed, this GST is charged to you via raw materials, services, or other items required by your company to work. Whatever products/items you purchased or services you hired for your business will charge you GST the same way you're charging GST to your customers.

Here's the best part, though - You can claim the GST back as a business expense if you are GST registered company in Singapore!

When filing for GST, a business will pay IRAS the net GST.

This is done by deducting Input Tax (GST paid for business purchases or services hired for the business) from Output Tax (GST your business charged and collected from customers).

If you paid more for GST than GST collected from customers, then IRAS will pay you the difference.

For example, your company collects S$1,000 of GST from customer purchases over the last three months and the GST you paid for purchases or services for the business is S$1,200, then it will look like this:

(Output tax) S$1,200 - (Input tax) S$1,000 = S$200.

IRAS will pay you S$200. If it's the other way around, like if your Input Tax is higher than Output Tax, then you'll need to pay the difference to IRAS.

Do You Need to Register for GST in Singapore?

I guess many business owners want to know whether GST applies to them first before learning about its ins and outs.

The short answer to you is:

Yes, if your taxable turnover exceeds S$1 million (compulsory registration)

Maybe, if you want to voluntarily register it even if your taxable turnover hasn't met the legal minimum yet (voluntary registration)

Let's look into more detail above compulsory and voluntary GST registrations in Singapore.

Compulsory GST Registration Singapore

According to IRAS, two ways exist to define the taxable turnover for Singapore GST registration.

On a Retrospective Basis - A business must register for GST when taxable turnover surpasses S$1 million at the end of

a) any calendar year (from 2019 onwards), or

b) a specific quarter, plus the previous three-quarters (before Jan 2019)

On a Prospective Basis - This is when a company expects to have more than S$1 million in taxable turnover in the next 12 months.

For companies that expect to hit more than S$1 million in taxable turnover in the next 12 months, the following documents are required:

Copies of 3 recent invoices (including shipping documents) issued to your customers OR all invoices if you have issued less than 3 invoices to your customers

Listing of your sales/ revenue for the past 2 months and the listing should include Date of Invoice, Invoice number, Name of Customer, Description of sales, Invoice amount

Copies of 3 recent purchase/ suppliers' invoices received, including shipping documents OR all invoices if you have made less than 3 business purchases

Listing of your business purchases for the past 2 months and the listing should include Date of Invoice, Invoice number, Name of Supplier, Supplier's GST Registration number, Description of purchase, Invoice amount excluding GST and GST amount

Copy of the latest Profit & Loss account, including reports and notes to accounts

Copy of rental agreement for your business office

So, when do you have to register the GST if you meet any of the criteria described above?

In summary, GST registration should be done within 30 days from

the date your duty to register arose (for a retrospective basis), or

the date of your forecast (for a prospective basis).

Check out the tables below for better illustrations.

Reference: IRAS

Voluntary GST Registration Singapore

Can business owners volunteer to register for GST if their annual turnover does not exceed S$1 million?

The answer is YES, as long as they meet the following requirements set forth by IRAS. You can check out the conditions here.

We will come back to address the benefits and drawbacks of voluntary GST registration in the sections below.

Any Exemptions From the GST Registration?

Yes, businesses may be exempted from GST registration even if their annual taxable turnover is more than S$1 million.

The exemption is granted if your business meets both conditions:

Over 90% of your overall taxable supplies are made up of your zero-rated items, and

You pay more GST than you collect. In other words, your input tax is more significant than your output tax.

Once a business owner is approved for exemption, they are exempted from

Collecting GST on sales and

Filing GST returns

The downside of being granted an exemption is that you cannot claim the Goods and Services Tax spent on company purchases.

How Do You Register for GST in Singapore?

The Singapore GST registration procedure is effortless and straightforward.

You can submit the application form via

Online (which applies to almost everyone): through myTax Portal, or

Paper (only for businesses with no access to myTax Portal): Download the GST F1 application form and send it together with the necessary supporting documents to:

55 Newton Road, Revenue House, Singapore 307987.

According to IRAS, it will take about ten working days to process your application. This is also assuming that you send the correct documents too.

Once the business is registered for GST, it must remain registered for two years. You may also hire a corporate service provider, like Piloto Asia, to assist you with GST registration in Singapore.

Special Notes to Voluntary GST Registration Process

The processing time will be longer if you voluntarily register GST. It may take up to three working weeks for voluntary registrations. This is because IRAS will ask you to sign up for GIRO, where you'll be making GST payments and refunds. GIRO application takes time to process, depending on your bank and how long it takes them to approve it.

GST Registration for Overseas Vendors

Overseas vendors will need to register for GST with the Inland Revenue Authority of Singapore (IRAS) under The Overseas Vendor Registration (OVR) Regime.

Starting 1 Jan 2023, GST is extended to low-value goods (LVG) imported into Singapore via post or air through the OVR Regime. This change allows local businesses to compete evenly against overseas vendors. The change is also implemented to ensure that the GST system continues to be resilient and fair as digital economy grows.

What’s The Definition of Low-Value Goods?

LVG Goods are defined as goods which at the point of sale:

are not dutiable goods, or are dutiable goods, but payment of the customs duty or excise duty chargeable on goods is waived under Section 11 of the Customs Act

are not exempted from GST

are located outside of Singapore and have to be delivered via post or air; and

have a value not exceeding the GST import relief threshold of S$400

Charging GST for Overseas Suppliers

OVR vendors are required to collect GST at the point of sale on supplies of low-value goods to:

Non-GST registered customers;

GST-registered businesses purchasing for non-business use

OVR Vendors are also required to pass down the following information down to their logistics chain so that relevant GST information is available for import permit application:

Whether GST is paid for each item; and

OVR Vendor’s GST registration number (GSTN)

Import GST relief is granted on goods imported by air, but goods such as alcohol and other intoxicating liquors and tobacco are excluded. This import relief is based on the total value of goods based on CIF (Cost, Insurance, and Freight) not exceeding S$400. ‘

As of 1 Jan 2023, there are no changes to the permit requirements and import procedure for goods imported after the said date so as long as the total CIF value of the consigned goods does not exceed S$400. However, importing of controlled goods such as liquors and tobacco requires the necessary important permits from their respective Competent Authorities (CA).

Do you have questions about how GST works in Singapore?

Fill up our form below to talk to one of our dedicated account managers.

We will get back to you in as little as 1 business day.

What Happens After You Register for GST?

Once you are successfully registered for GST, IRAS will send you a letter of notification.

Please take note of the effective date of the GST registration, as this will be the date when you start charging and collecting GST.

You'll also need to do the following:

show GST registration number on your receipts and invoices

Determine what GST rates will apply to your goods and services (we'll discuss this in the following sections)

Submit monthly or quarterly GST returns to IRAS

Make GST payments to IRAS

To support the GST declaration and claim the taxes, keep your business records and invoices dating back at least five years. If you lose some of them, you may be unable to claim the taxes back.

How Is GST Applied? What Kinds of Products and Services Are Subject to GST?

The current GST rate is 7%. But not all goods and services are charged this standard rate.

Before we discuss the types of goods and services that are subject to GST, we'll need to talk about the two GST rates that business owners should be aware of:

Standard Rated Supplies: GST is charged at 9% and applies to most goods or services sold.

Zero Rated Supplies: Certain goods and services fall under the zero rate. This means you can't charge GST on your customers with these zero-rated supplies.

So, Singapore's GST rate can be either 9% or 0%.

Next, you need to know under what instances the GST is applied.

GST is applied to the supply of goods and services in Singapore

GST is applied to the import of goods to Singapore

GST can be exempted from certain goods and services

See the summary below for your reference:

Taxable Supplies

Reference: IRAS

Non-Taxable Supplies

Reference: IRAS

Applicable to Supply of Goods and Services

GST is only applied when the "place of supply" or the business is in Singapore. Supply refers to the activity of providing goods to further the business of a taxable person.

This means that the physical transfer of ownership of goods is done in Singapore.

For example, a gas station providing petrol to customers is considered a "supply of goods" because the station receives money in exchange for the petrol they provide.

Another example:

If a Singapore company sells to an overseas company, but the ownership of said goods is transferred to a customer of the overseas company in Singapore, then GST will be applied.

Applicable to Import of Goods and Services

When goods are imported, or if there are imported services, into Singapore, they are subject to GST. The total value of import is taxes, including additional fees such as applicable Customs duties and Cost, Insurance, and Freight (CIF), etc.

Here's an example of how to calculate the value of imported goods and the applicable GST:

Cost of Goods = $10,000

Insurance and Freight = $2,000

CIF Value = Costs of Goods + Insurance and Freight = $12,000

Customs Duty = $3,600

Value of Import = CIF Value + Customs Duty = $15,600

GST @9 of Values of Import = $15,600 * 9% = $1,092

Exempt & Zero-Rated Supplies

There are instances where GST may not be applicable.

Type 1 - Exempt Supply

Certain goods and services are exempted from GST through the Fourth Schedule of the GST Act. These include:

Provision of financial services, e.g .issue/sale of shares

Importation and local supply of precious metals

Sale and lease of residential properties

Type 2 - Out-of-Scope Supply

Out-of-scope supply refers to the collection of goods and services outside of Singapore. These are outside the scope of the GST and, therefore, not taxable. However, businesses must retain specific records to prove that these transactions are made overseas.

Type 3 - Zero-Rated Supply

Zero-rated supply does not equate to exemption. Instead, GST is charged at 0%, hence 'zero-rated'.

Zero-rated GST is applied to:

Goods that will be/have been exported

International services, i.e. Supply of services towards foreign-based clients (Note that not all of them can enjoy zero-rated - check here)

Like the out-of-scope supply exemption, zero-rated supplies require evidence to prove that the goods being supplied are exported.

However, a business can still claim a GST input tax deduction for any inputs used to make the zero-rated goods or services.

How to File GST Return

All GST registered businesses need to file GST tax returns to the Inland Revenue Authority of Singapore (IRAS).

There are a few critical points to remember for GST returns filing in Singapore:

All GST returns must be filed electronically, either monthly or quarterly.

The GST tax return and payment of the GST amount are due one month after the prescribed accounting period.

Businesses must still file a NIL return even if there were no transactions that charged GST during an accounting period.

As mentioned above, businesses will pay IRAS the net GST when they GST returns.

Let us remind you again of the definition of net GST below:

Net GST = Output Tax (the GST you charged and collected) - Input Tax (the GST you paid on business purchase).

If your input tax is greater, IRAS will refund you. But if your output tax is greater, you're going to pay this tax amount to IRAS.

Let's get an example.

Your input tax is S$20

Your output tax is S$10

IRAS will refund you a net GST of $10.

In contrast, there are instances when output tax is greater than input tax.

Your output tax is S$20

Your input tax is S$10

Then you will need to pay S$10 net GST to IRAS.

If IRAS has to issue a tax refund to a business, this refund is made

Within one month, if it's a monthly accounting period

Within three months, if it's a quarterly accounting period.

But before you can receive a GST refund, you have to meet the following conditions:

File all your GST returns on time.

Your business must not be under audit by the Comptroller.

Your business does not have outstanding taxes or payments.

Should Your Business Register for GST Voluntarily?

Here are some things to consider if registering for GST voluntarily suits your Singapore company.

Factor 1 – Net GST

A GST-registered company in Singapore can offset input taxes paid against output taxes they collected (or what we refer to as net GST).

If you think your business will have to pay a lot of input tax compared to the output tax, it might be good to register for GST. This will allow you to get a refund from IRAS.

Factor 2 – Record Keeping & Filing Obligations

A GST registered business must adhere to the law's recordkeeping, accounting, and filing protocols. You might need to hire an in-house accountant, or a corporate service provider, to help you with this.

However, because of this GST obligation, your firm will have to spend more money on things like overhead costs.

Factor 3 – Customers Are Charged GST

GST-registered businesses will need to charge GST on their customers’ taxable goods and services. This means your customers will need to pay more on top of the price they're paying.

If your competitors are not registered for GST, your customers might think you are more expensive than them.

Factor 4 – Customer Perception

Customer perception can also be a factor in deciding whether or not to register for GST.

If your business is not GST-registered and they expect you to be, then they'll end up having a negative perception of your business. They will think you're unreliable, even if your business doesn't need to be registered.

Talk to a corporate service provider or professional accountant to see whether you should get a GST registration for your firm (assuming you don't fall under the mandatory registration category).

Different GST Incentive Schemes

The Singapore Government offers different incentives and schemes to help business owners eliminate GST complexity.

Several types of incentives are available to businesses; some are general, while others are industry-specific. For instance:

Major Exporter Scheme (MES)

The Major Exporter Scheme (MES) applies to non-dutiable goods

where GST is suspended at the point of import, and

when goods are removed from Zero GST warehouses.

This scheme is meant to ease businesses' cash flow that import and export goods substantially.

Typically, businesses must pay GST upfront on imports and obtain a refund from IRAS after submitting GST returns.

This often causes cash flow problems for companies that export substantially. This is because no GST is collected from zero-rated supplies to offset the initial cash outflow of imports.

Gross Margin Scheme

Sellers who purchase goods secondhand don't have to pay GST.

The Gross Margin Scheme lets companies account for the GST on the gross margin instead of the total value of the goods supplied.

Let's say you are a seller of secondhand computers. You bought a computer from a non-GST registered person for $120 and sold the computer to your customer for $350.

What's your gross margin? It will be $350-$70 = $280

Based on the Gross Margin Scheme, your GST (i.e. output tax) will be charged based on a) your gross margin and b) a tax fraction of 7/107.

So the total GST = $280 * 9 /107 = $1.83

What if your gross margin is negative, i.e. selling price < purchase price, and you make a loss?

Well, if that's the case, the gross margin is regarded as zero, and GST won't be charged. However, the selling price must still be reported in the GST return.

Zero GST Warehouse Scheme (ZG)

Approved businesses can store non-dutiable overseas goods in the Zero GST Warehouse (ZG) without paying GST on said goods.

This GST is only payable when the approved companies import goods from the warehouse for local consumption. Singapore Customs carries out this particular scheme.

Tourist Refund Scheme

This GST scheme is popular amongst tourists as it allows them to claim a refund of the GST paid if these goods are brought out of Singapore. Note that the retailers in Singapore should be GST-registered to enjoy the benefits of this scheme.

Cash Accounting Scheme

The scheme is made available for small businesses whose annual sales do not exceed S$ 1 million. It was developed to help alleviate the cash flow of small businesses whose yearly sales don't exceed $1 million.

Through this scheme, you only account for output tax once you receive customer payment, which eases cash flow. When you claim input tax, you only do so when you pay your suppliers.

Hand-Carried Exports Scheme

This scheme is applicable to business owners who plan on using zero-rate supplies to overseas customers for goods that are hand-carried out of Singapore through Changi International Airport.

The HCES does not apply to goods hand-carried out of Singapore by air (through Seletar Airport), sea, or land.

Discounted Sale Price Scheme

The Discounted Sale Price Scheme allows business owners to charge 50% GST on secondhand or used vehicles.

Import GST Deferment Scheme (IGDS)

Approved GST-registered businesses will only pay GST on imports when their monthly GST returns are due, rather than paying them at the time of importation. This eases import cash flow between payment of import GST and claiming import GST for GST registered business.

What Should Businesses Do With The New GST Rate?

As mentioned above, the GST increase has occurred from 8% to 9% since January 2024. As business owners, you should consider the following on how it affects your business:

Any transitional time of supply rules to make sure that GST is accounted for at the current and correct rate. You’ll likely follow the tax invoice date, but IRAS will confirm this.

You might also want to consider how the new GST rate will affect your pricing, and whether or not GST is passed to your consumers.

You’ll need to make sure that your ERP or accounting software, eCommerce platforms, EPOS systems, and billing systems are updated with the current GST rate at 9%.

You’ll need to ensure that your stakeholders know about the GST rate increase and how this will affect your customers, suppliers, and other GST-sensitive matters.

Closing

Knowing about the Singapore Goods and Services Tax (GST) is crucial for business owners, foreign and local, for doing business in Singapore. Knowing about GST rules will not only help you avoid nasty tax penalties, but it will also help you save money in the long run, thanks to the numerous incentive schemes developed by the government.

If you want to know more about GST registration or how it works, you can talk to one of our dedicated accountants here at Piloto Asia. We are one of the best GST registration services in Singapore.

Frequently Asked Questions about Singapore GST

-

According to the Inland Revenue Authority of Singapore (IRAS), GST-registered businesses are required to charge GST on all sales of goods and services made in Singapore.

This includes standard-rated supplies where GST is chargeable at 8%, as well as zero-rated supplies where GST is applied at 0% for the transaction. Additionally, there are specific scenarios where GST may need to be charged or deemed, such as the recovery of expenses, gifts and samples, and the issue of vouchers.

-

Some businesses are exempted from charging GST in Singapore. This includes businesses that provide most financial services, supply digital payment tokens, engage in the sale and lease of residential properties, and those involved in the importation and local supply of investment precious metals. It is important to note, however, that businesses making only exempt supplies are not eligible to register for GST, and as such, they cannot claim GST incurred on their business purchases.

-

Your business needs to register for GST in Singapore if its annual taxable turnover exceeds or is expected to exceed SGD 1 million. Additionally, businesses that make only zero-rated supplies (supplies subject to 0% GST) can also voluntarily register for GST to claim input tax credits on their purchases.

-

The accounting entries for GST in Singapore may include the following:

Input Tax: This represents the GST paid on business purchases and expenses. It is recorded as a credit in the Input Tax account.

Output Tax: This is the GST charged on sales and services provided by the business, and is recorded as a debit in the Output Tax account.

GST Payable: This is the net amount of GST to be paid to IRAS, calculated as the difference between the Output Tax and Input Tax. It is recorded as a liability in the GST Payable account.

GST Receivable: If the Input Tax exceeds the Output Tax, the excess is recorded as an asset in the GST Receivable account.

Bad Debt Relief: If a business has paid GST on bad debts, it can record this relief as a credit in the Output Tax account.

Adjustment for Partial Exemption: Business that makes both taxable and exempt supplies may need to make adjustments, which are recorded in the Partial Exemption account.

It's important to note that the specific accounting entries may vary depending on the nature of the business and the GST transactions involved. For more detailed information, businesses are advised to seek professional advice and refer to the official IRAS guide on GST accounting and compliance.

-

A GST-registered company in Singapore refers to a business that has either voluntarily registered for GST or has been required to do so due to its taxable turnover exceeding the threshold. A GST-registered company is authorized to charge and collect GST on its taxable supplies. Additionally, it is required to file GST returns and is eligible to claim input tax credits on its business expenses.

-

Being a GST-registered company in Singapore comes with several benefits:

Claiming Input Tax: GST-registered companies can claim input tax incurred on purchases and expenses made for business purposes. This can help to reduce the overall GST liability and improve cash flow.

Competitive Advantage: Being GST-registered can boost a company's credibility and reputation, as it signals that the company is a legitimate and professional business that is compliant with regulations.

Expansion Opportunities: Familiarity with the GST system can facilitate business expansion into countries with similar GST or Value-Added Tax (VAT) systems.

Compliance with Regulations: GST registration ensures that companies comply with GST regulations, promoting legal and responsible business operations.

Simplified Accounting: GST registration allows businesses to use the GST accounting method, which involves recording the GST separately and claiming input tax credits. This can save time and reduce potential errors in the accounting process.

It's important to note that the benefits of being a GST-registered company may vary depending on the nature of the business and the GST transactions involved. Businesses are advised to seek professional advice and refer to the IRAS for more information on GST registration and compliance.

-

Being GST registered in Singapore is important for several reasons. Firstly, it allows your business to comply with the GST laws and regulations, enabling you to charge and collect GST on taxable supplies. Secondly, it enables you to claim input tax credits, which reduces your overall GST liability. Additionally, being GST registered enhances your business's credibility and allows you to engage in transactions with other GST-registered businesses.

-

The filing period for GST in Singapore depends on the annual turnover of the GST-registered company. For businesses with an annual turnover of less than SGD 5 million, the filing period is quarterly. For businesses with an annual turnover of SGD 5 million or more, the filing period is monthly. Regardless of the filing frequency, the GST return and payment are generally due within one month after the end of the respective filing period.

-

The penalty for late filing of GST in Singapore can vary depending on the extent of the delay. If the GST return is filed late, a penalty of SGD 200 will be imposed for the first offense and SGD 500 for subsequent offenses. Additionally, late payment of GST may result in a 5% penalty on the outstanding tax amount, along with potential interest charges.

-

A GST audit in Singapore refers to the process where the Inland Revenue Authority of Singapore (IRAS) examines and verifies a business's GST records to ensure compliance with GST laws and regulations. The audit aims to ensure accurate reporting, proper documentation, and adherence to GST requirements. The audit process may involve reviewing transactions, invoices, and supporting documents, as well as conducting interviews with the business owners or representatives.

-

During a GST audit in Singapore, IRAS conducts a comprehensive review of a business's GST records.This includes a review of transactions, invoices, and supporting documents. As part of the audit process, IRAS may conduct interviews with business representatives, carry out inspections of business premises, and analyze financial and operational data. The goal is to assess the accuracy and compliance of the GST reporting, identifies any discrepancies, and may issue assessments, penalties, or further investigations if non-compliance is found.

-

When it comes to exporting goods from Singapore, it is important to know that these transactions are generally zero-rated, meaning they are subject to a GST rate of 0%. However, to qualify for this, the businesses must meet certain conditions. One key requirement is maintaining accurate proper documentation and evidence that substantiate the zero-rating of the supply. Additionally, understanding and complying with the specific GST rules, requirements and customs regulations for exporting goods is essential.

-

The Goods and Services Tax (GST) Singapore Act is a Singaporean law that provides for the imposition and collection of GST in Singapore and for matters connected therewith. The Act was first enacted in 1993 and has since been amended several times, most recently in 2021. The Act sets out the rules and regulations for the charging, collection, and reporting of GST in Singapore, including the registration requirements for businesses, the calculation of GST, and the filing of GST returns. The Act also outlines the penalties for non-compliance with GST regulations, including late filing or non-filing of GST returns, and the procedures for GST audits and investigations.

-

Yes. At Piloto Asia, our accounting service can help you with GST registration and compliance in Singapore. Our seasoned team of professionals will guide you through the understanding of GST requirements, ensuring a smooth registration process, and keeping you updated with the latest changes to the GST law. Reach out to us at Piloto Asia, and let's make GST registration and compliance a hassle-free process for your business!

-

Investment Holding Companies like other businesses, are required to register for Goods and Services Tax (GST) if their annual taxable turnover exceeds SGD 1 million

It's also important to note that some businesses may choose to voluntarily register for GST even if they do not meet this threshold. This decision often depends on the nature of the business activities and whether the benefits of claiming input tax credits outweigh the administrative costs of GST compliance

-

Corporate tax in Singapore is a tax on the profits of companies, while GST is a tax on the consumption of goods and services. Companies registered for GST must collect GST from their customers and remit it to the government. However, companies can claim a deduction for the GST they incur on their purchases.

-

The filing deadlines in Singapore for GST returns are Monthly returns (Due one month after the accounting period) and Quarterly returns (Due one month after the end of the quarter).

-

Setting up a holding company in Singapore offers several strategic advantages, particularly when considering GST regulations. One key reason to set up a holding company in Singapore is the favorable tax environment, including the efficient GST framework. Holding companies can benefit from Singapore's clear and business-friendly GST regulations, which may enhance the management of their investments and subsidiaries. Additionally, Singapore's robust legal system and stable economic climate make it an ideal location for holding companies looking to invest in the Asia-Pacific region. The Singapore GST guide for business owners provides further insights into how GST applies to holding companies, helping them to optimize their tax efficiency and compliance.

-

The Goods and Services Tax (GST) Act in Singapore outlines the tax regulations related to the supply of goods and services in the country, and it also applies to the importation of goods. Singapore introduced GST on April 1, 1994, which is managed by the Inland Revenue Authority of Singapore (IRAS).

-

Singapore Financial Reporting Standards and GST obligations, while related, serve different purposes. SFRS, established by the Accounting Standards Council (ASC), dictate the accurate recording and presentation of financial transactions in your financial statements. These standards ensure that your financial reports reliably reflect your business's financial performance and position.

GST, or Goods and Services Tax, is a consumption tax applied to the supply of goods and services in Singapore and the import of goods. Your GST obligations are determined by tax legislation, focusing on the nature of your transactions and whether they are subject to GST.

While SFRS itself does not directly affect your GST liabilities, the financial statements prepared under SFRS provide essential information for GST reporting. For instance, revenue recognized in your financial statements under SFRS may help determine your taxable supplies for GST purposes. Therefore, accurate financial reporting according to SFRS is crucial for fulfilling your GST obligations correctly.

Piloto Asia, as your dedicated corporate service provider, is here to assist you in navigating both the complexities of SFRS compliance and managing your GST reporting obligations. Our expertise ensures that your business remains compliant with Singapore's financial and tax regulations, safeguarding against potential discrepancies and penalties.

-

Navigating the Goods and Services Tax (GST) landscape in Singapore can be challenging for businesses. Piloto Asia's outsourced accounting services in Singapore are specifically designed to ease this burden.

Our team of professional accountants brings deep expertise in Singapore's GST framework, ensuring your financial transactions are meticulously organized for compliance. We can organize your financial transactions, provide accurate and timely GST filing, and offer strategic advice to optimize your tax position.

By choosing our outsourced service, you not only achieve compliance with confidence but also free up essential resources to concentrate on your core business activities. Ensuring GST compliance is crucial for the success and smooth operation of your business in Singapore, and we're here to help you achieve just that.

-

At Piloto Asia, we recognize the complexities of navigating Singapore's tax environment for businesses. Understanding the interaction between Singapore company tax and GST registration is crucial for compliance and optimal tax planning. Corporate tax in Singapore is levied at a flat rate of 17% on the chargeable income of companies, focusing on the profits earned. On the other hand, GST is a consumption tax applied at 7% on the supply of goods and services, affecting the pricing and sales processes of businesses.

While corporate tax and GST are calculated and managed separately, they are interconnected in the broader scope of a company's financial and tax planning strategies. For instance, GST-registered businesses must account for GST on their taxable supplies, which can impact their cash flow and operational costs, indirectly influencing their taxable profits and, consequently, their corporate tax obligations.

Our detailed guides on corporate tax and GST in Singapore provide essential insights for businesses to navigate these obligations effectively, ensuring compliance and leveraging available tax benefits to optimize their overall tax position.

-

As Singapore's #1 corporate service provider, Piloto Asia prides itself on its ability to provide a comprehensive range of business services, including affordable company formation services. We cater to both local and foreign business owners, guiding you through every step of the process to ensure that setting up your business is smooth and hassle-free. Our transparent pricing ensures you receive high-quality service without any hidden costs, making business formation both accessible and efficient.

Further Reading...