2025 Personal Income Tax Guide for Locals and Foreigners in Singapore [Updated]

If you earn more than S$22,000 annually in Singapore, you’ll likely be required to pay income tax. Whether you’re a local, a foreign employee, or self-employed, understanding Singapore’s personal income tax regulations—set by the Inland Revenue Authority of Singapore (IRAS)—is essential. Staying informed helps you avoid unnecessary tax complications during the filing season.

In this guide, we provide a comprehensive summary of tax-related matters and taxation in Singapore that individuals should pay attention to.

Ready to Start Your Singapore Business Journey? Let Us Help

Whether you're interested in taking advantage of Singapore's business-friendly environment or need guidance on setting up efficiently, our team at PilotoAsia is here to help.

With our expertise in incorporation, compliance, and ongoing support, we’ll handle the complexities so you can focus on growth.

Contents

- Singapore personal income tax regulations at a glance

- Do you need to pay individual taxes? Employee vs Self-employed

- Determining your tax residency status - Why it matters

- Difference in tax rates for resident vs non-tax residents

- Tax Clearance – Who needs it, when would you need it and how to go about it

Tired of wasting time and money on solutions that don’t work? At Piloto Asia, we deliver what others can’t—tailored solutions that fit your business like a glove, ensuring long-term success in Singapore’s competitive market.

We understand that every business is unique. That’s why our expert team crafts personalized strategies designed to cut costs, save time, and optimize your operations.

Ready to see real results? Fill out the form below to take the first step toward a faster, more cost-effective solution. Tell us a bit about your needs, and we’ll provide a tailored plan that works.

Expect to hear back from our team within 24 hours of submission.

Singapore Personal Income Tax Rate & Regulations at a Glance

Singapore follows a progressive personal income tax system, where the tax rates range from 0% on the first S$20,000 of chargeable income to a top marginal rate of 24% on chargeable income exceeding S$1,000,000. Filing of tax returns is required if your annual income is S$22,000 or more. Starting from the Year of Assessment (YA) 2024, the top marginal Personal Income Tax rate has been increased from 22% to 24%.

The rates are structured as follows:

0% on the first S$20,000

2% on the next S$10,000

3.5% on the next S$10,000

7% on the next S$40,000

11.5% on the next S$40,000

15% on the next S$40,000

18% on the next S$40,000

19% on the next S$40,000

19.5% on the next S$40,000

20% on the next S$40,000

22% on the next S$180,000

23% on the next S$500,000

24% on income exceeding S$1,000,000

Individuals need not pay any inheritance tax or capital gain.

Singapore levies tax only on the income earned in the country. Apart from a few exceptions, overseas income is exempted from taxation.

The tax regulation in Singapore varies according to an individual's tax residency.

Every year, the due date of tax filing is 15 April (18 April if filed electronically), failing which can lead to penalties.

The Income tax in Singapore is assessed on a preceding-year basis.

As of January 2025, gains received in Singapore from the sale of foreign assets remain exempt from taxation, as Singapore does not impose a capital gains tax.

Primary Difference in Personal Income Tax between Employee vs Self-employed

Personal tax varies for employed and self-employed individuals in Singapore according to the tax regulations set by IRAS. It is important to know where you lie. So, which are you?

- Employees: In Singapore, an individual who is serving a contract of service is considered an employee. This means that the person is entitled to receive a regular salary and incentives and is under the rule of an employer.

- The self-employed: A self-employed individual in Singapore is the one who offers services to others, works for himself, and earns taxable income. Under this category, there are freelancers, hawkers, baby sitters, direct sellers, traders, agents, etc. Hence, a self-employed can either be the sole owner of their proprietorship or have a partnership in business. (More about common types of business entities in Singapore here)

Determining Your Tax Residency Status – Why It Matters

Your tax residency status plays a pivotal role in determining whether an individual staying in Singapore is eligible for paying personal income tax.

Non-tax residents are taxed at a flat rate of 24% (except for Singapore employment income which is taxed at a flat rate of 15%, and some types of income are taxed at a reduced withholding rate)

versus

Much lower progressive tax rates for tax residents

For instance, a Singapore tax resident with an annual income of up to S$100,000 would pay roughly 6% in effective tax rate.

Broadly, your tax residence is determined by your period of stay and the number of days you’re under employment in Singapore.

Tax Resident Singapore

You are classified as a tax resident if you stay or work in Singapore:

For at least 183 days in a calendar year

For at least 183 days for a continuous period of 2 years

Continuously for 3 consecutive years

In calculating your days of Singapore employment, weekends and public holidays are usually considered. Temporary absence from Singapore due to travels like vacation, leave, or business trips are also included.

As a Singapore tax resident, you will be:

Taxed on annual income earned in Singapore (taxable income)

Taxed on income after tax relief deductions (or any tax deduction) at progressive resident rates

Taxed on foreign sourced income brought in Singapore before 1st Jan 2007

Exempted from tax for foreign sourced income or individual income brought in Singapore on or after the 1st Jan 2007 as long as it is not received through partnerships in Singapore.

Sample tax resident scenarios

a) You are in Singapore for at least 183 days

You have stayed or worked in Singapore from 3 May 2021 to 6 Nov 2021, which sums up to 187 days. You will be treated as a tax resident for the 2022 Year of Assessment.

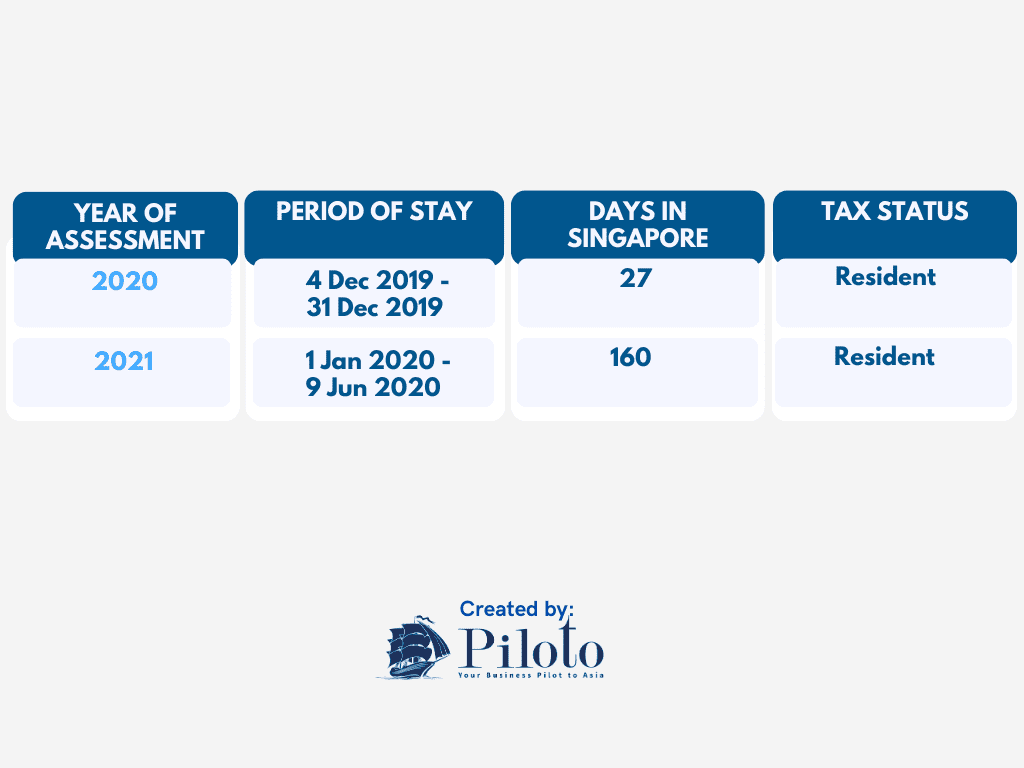

b) You are in Singapore for at least 183 days over 2 years

You have stayed or worked in Singapore for an ongoing period, between 4 Dec 2019 and 9 June 2020, which makes up to 187 days. You will be treated as a tax resident for the 2 years under administrative concession. You remain a tax resident for the 2020 and 2021 year of assessment. i.e. both 27 and 160 days make up 187 days.

c) You are in Singapore for 3 consecutive years

You have stayed or worked in Singapore for 3 years ongoing even if you were in Singapore for less than 183 days in the first and third year. You will be a tax resident for all the 3 years of the administrative concession. Consider you worked or stayed in Singapore from 4 Dec 2019 to 9 June 2021. You will be a tax resident for 2020, 2021, and 2022 years of assessment.

Both 27, 365, and 159 days make up 551 days.

Non tax resident Singapore

Non-tax residents refer to individuals who have stayed and worked in Singapore for less than 183 days. A non-resident individual is required to file for income tax returns by filling out form M and failing to do so would incur a late penalty from IRAS. Business owners who manage their Singapore business remotely or frequently travel in and out of the city belong to this group. Oftentimes, a convenient option would be to outsource to a professional tax preparation services provider.

As non-tax residents:

You are only taxed on individual income earned in Singapore

You are not entitled to tax relief

Your employee income is taxed at a flat 15% personal income tax rate or the progressive resident rates, whichever is higher.

Other income earned from Singapore or directors fee is taxed at a prevailing non resident tax rate of 24% for YA 2024 and onwards.

Sample tax non-resident scenarios

Scenario One: You have stayed or worked in Singapore for 60 days or less

Non-residents who exercise employment in Singapore for less than 60 days have an employment income tax exemption, i.e. your short-term employment is exempt from tax. However, in the case you are a Singapore company director, a professional, or a public entertainer you are not included in this category. If you are absent from Singapore due to matters that are incidental to your employment, resident tax rates would still apply to you, which means your total income including that earned for service given outside of Singapore is taxable.

Further illustrating the above scenarios:

i) Suppose you work and stay in Singapore in short-term employment for 60 days or less in a year:

ii) Suppose you stay and work in Singapore a short time because you have been extensively travelling overseas on business trips related to your employment in Singapore, your income earned including services given on your overseas trips is taxable in full.

Scenario two: Employment of 61-182 days in a year

If you are a tax non-resident who works for 61-182 days in a year in Singapore, you are not entitled to income tax reliefs. Your employment income will be taxed at the non-resident rate of 15%, or the progressive resident rate, whichever is higher. Note a 24% tax on Directors Fee still applies.

Example

| Year of Assessment | Period of Stay | Days in Singapore | Tax Status |

|---|---|---|---|

| 2022 | 4 Jul 2021 - 31 Dec 2021 | 180 | Non-resident |

Determining the tax resident status of individuals or companies has important implications. As a rule of thumb, if you are a frequent traveller, you may wish to clock your travel days and plan accordingly. For businesses, achieving tax resident status would also open up benefits such as exemptions to new start-up companies, or other benefits conferred under various double taxation agreements.

Difference in Income Tax Rates in Singapore for Residents vs Non-Tax Residents

Is there a difference in taxes payable by residents versus non-tax residents? Yes you bet.

By now, you shall already know that:

If you are a Singaporean citizen, Singaporean permanent resident, or a foreigner who stays or works in Singapore for 183 days of a year or more, you are a Singapore tax resident.

If you are none of the above, you are a non-tax resident of Singapore and will be taxed at 24% flat rate (except for Singapore employment income which is taxed at a flat rate of 15%, and some types of income are taxed at a reduced withholding rate).

The below table gives a quick glance at how much tax you could expect to pay as a tax-resident individual versus a non-tax resident individual, rates from YA2017 onwards:

As you could conclude, being a tax resident yields significant advantage in lower taxes for most low-medium income earners. In general, if your personal income does not exceed S$320,000 – S$400,000 threshold, your local tax residence status could save you a decent amount of tax. If you are a frequent traveller, you may wish to take note of your number of days spent in Singapore.

The above calculations are derived from the below tax resident rates if you are interested in some numbers crunching.

Tax Deductions and Reliefs in Singapore

Singapore's tax system offers a variety of deductions and reliefs, which are crucial for reducing your taxable income and maximizing tax benefits. Here are some key areas covered:

CPF Relief for Employees: Contributions to your own or your family members' Central Provident Fund (CPF) accounts are eligible for tax relief. This is an important aspect of tax savings for employed individuals.

Rental Deductions: For rental income, you can deduct expenses such as property tax, mortgage interest, maintenance, and utility costs. This includes expenses incurred solely for producing rental income and during the period of tenancy. Additionally, a deemed rental expense calculated at 15% of the gross rent can be claimed for residential properties.

Donations: Donations made to approved Institutions of Public Character (IPCs) are eligible for a 250% tax deduction. This means for every S$1 donated, S$2.50 can be deducted from your taxable income.

Course Fees Relief: Up to S$5,500 per year can be claimed for fees paid for courses, seminars, or conferences that upgrade professional skills or add to vocational qualifications.

Life Insurance: If your CPF contribution is lower than S$5,000, you can claim relief for life insurance premiums paid. This relief is particularly beneficial for those with lower CPF contributions.

Parent/Handicapped Parent Relief: Supporting dependent parents, grandparents, or in-laws can qualify you for parent relief, ranging from S$5,500 to S$14,000, depending on the living arrangements and number of dependents.

Tax Clearance – Who needs it, when would you need it and how to go about it

Tax clearance is the process whereby you as a non-Singapore Citizen employee (e.g. Singapore PR, EP holders, PEP holders, S Pass holders) settle all your taxes due, before the expiry of a contract for work, or when you decide to work for another employer, and lastly, in cases where you plan to leave Singapore for a period of more than 3 months. It’s the obligation of your employer to ensure you pay all taxes due before you go.

For instance – When you leave a current employer, your employer would notify IRAS in good time to calculate your tax liability up to your last working day. All tax liabilities that you owe will have to be settled before you leave Singapore or you move on to your new job.

Typically, the employer will fill up an IR21 form to be submitted to IRAS for tax clearance. The employer shall also withhold payment of all monies due to you from the day of resignation (including salary, bonus, overtime pay, etc) to account for taxes payable to IRAS.

After form IR21 is submitted, IRAS would determine your tax liability by looking into the income you earned in the year of departure and that of the preceding year which was not assessed. A tax clearance directive would then be sent to your employer who would remit the tax amount liable to IRAS. In cases where monies withheld are more than the amount payable stated in the tax clearance directive, the employer will release the balance to you.

Do remember for foreigners intending to leave the country, you will only be able to leave after all tax dues are settled. If your taxes are not settled, you will be stopped from leaving Singapore and in such instance, you will need a release letter from IRAS.

Hello, World!

FAQ About Personal Income Tax in Singapore

-

There are two ways to file your income taxes - paper filing and electronic filing. Majority of taxpayers file their taxes online as it's relatively easier. You just have to login to IRAS’s myTaxPortal with your SingPass and follow the instructions for income declaration, computing for deductions, and claiming tax reliefs.

-

Tax returns are filed on a calendar-year basis and there are two deadlines for filing 15 April for paper filing and 18 April for electronic filing.

Income is assessed based on the preceding year, ending 31 December.

For example, if you need to file your taxes for the year ending 31 December 2022, you'll need to file by 15 April 2023 for paper filing, or by 18 April 2023 for electronic filing.

Income tax bills are sent out to taxpayers by the end of April of the same year. Make sure you file the tax returns and make the tax payments on time to avoid fines, interest charges and legal action.

-

Foreign income received in Singapore, including those paid out to a Singapore bank account, is generally exempt from taxation and hence does not need to be declared in your income tax return.

However, there are exceptions to this rule. For example, if you are a resident individual receiving foreign-sourced income through a partnership, that income will then be subject to taxation.

-

You have several options to pay your personal income tax in Singapore.

The first and preferred option is via GIRO, which allows you to make either a one-time payment or spread your payments over 12 months with interest-free instalments.

In addition, you can also make electronic payments through internet banking, phone banking, or mobile banking services like PayLah and PayNow.

If you prefer to pay in-person, you can also visit a post office and make your payment using NETS.

Overall, Singapore offers a range of payment options for your convenience to ensure that you can easily pay your income tax.

-

Tax resident individuals can use this income tax calculator from IRAS, while non-resident individuals can use this income tax calculator.

-

The amount of Singapore personal income tax that you need to pay depends on your income level, tax residency status and personal allowances.

Singapore tax residents are eligible for certain personal allowances and are subject to graduated tax rates. The current tax rates for tax residents vary between 0% to 22%, and they will go up to 24% in Year of Assessment (YA) 2024. Income tax rates are progressive, meaning the higher your income, the higher your tax rate.

Non-tax residents are not eligible for personal allowances and are taxed at a flat rate of 22%, which will also increase to 24% in YA 2024.

-

Income tax in Singapore is progressive for tax resident individuals. This means the more income they earn, the higher their tax rates. But thankfully, there are ways to help reduce income tax. As of this writing, there's a tax relief limit of S$80,000 which is the total amount of the tax relief provided to you for any given YA.

Here's how to reduce your personal income tax:

Enroll in courses that upgrade your skills. The courses need to be relevant to your employment and you'll need to prove that you've paid for the course yourself. You can get up to $5,500 in tax relief per year.

Top up your Central Provident Fund (CPF) Special Account. Tax is automatically deducted once you've completed the top-up. You can get a maximum of S$14,000 in tax relief per YA - S$7,000 for yourself and another S$7,000 for family members.

Donating to charity also reduces income tax as long as the charities are registered as an IPC (Institute of Public Character) in Singapore. You can get as much as 250% of the amount donated in tax deductions.

Serving as a National Serviceman or NSMan of the Singapore Armed Forces qualifies you for tax relief. As of YA 2022, if you've performed your NS duties, your tax relief as a key appointment holder (KAH) will range from S$3,500 to S$5,000. General population NSMan (Non-KAH) will enjoy tax reliefs up to S$3,000.

You can get tax relief via the life insurance tax relief on premiums paid to your own or your spouse's life insurance.

If you're a business owner, you can claim business expenses such as accounting fees, advertising fees, and CPF contributions as tax-deductible expenses.

Rental expenses are also tax deductible. Rental expenses refer to expenses generated after incurring rental income. 15% of the gross rental income may be claimed.

-

The Auto Inclusion Scheme (AIS) is a tax scheme in Singapore that allows employers to submit their employee's earnings data to IRAS digitally, using the prescribed format. IRAS will then use the data to pre-fill the employees’ tax returns, saving them time and effort in filling out their tax forms, which used to be hardcopies.

IRAS mandates that AIS is compulsory for companies if:

they have at least 5 or more employees as of the Year of Assessment (YA) 2022, OR

the business owner received a notice from IRAS to file for AIS

-

The Inland Revenue Authority of Singapore (IRAS) considers non-Singaporean and non-Singapore permanent resident individuals as foreigners for tax purposes. Your tax liability as a foreigner is determined by two main factors: your tax residency status and source of income.

All individuals, regardless of their nationality, are subject to tax on income derived from Singapore.

Your tax residency status is determined by the duration of your stay in Singapore. Please refer to the definition of tax residency here for further explanation.

Non-residents who work in Singapore for 60 days or less during a calendar year are exempt from paying tax on their income earned in Singapore. It is important to note that this exemption does not apply to directors of companies, public entertainers, or professionals in Singapore.

Foreign-sourced income received by a tax resident is generally not taxable unless it is received in Singapore through a partnership.

-

Yes, foreigners working in Singapore, whether employed or self-employed, are generally subject to Singapore income tax on their income earned within the country.

However, the tax liability may depend on factors such as the duration of stay, tax residency status, and the existence of double tax agreements between Singapore and the individual's home country.

-

The income tax for foreigners in Singapore is calculated based on the progressive tax rate system, which means that the tax rate increases as the income level rises. The tax rates and income tax brackets are periodically updated by the Inland Revenue Authority of Singapore (IRAS). It is important to note that non-residents may be subject to different tax rates compared to tax residents of Singapore.

-

Tax residency in Singapore is determined based on the duration of stay or work in Singapore. If you are a Singapore Citizen or Singapore Permanent Resident who normally resides in Singapore, you are considered a tax resident. Foreigners can be classified as tax residents if they have:

Stayed or worked in Singapore for at least 183 days in the previous calendar year.

Worked in Singapore continuously for three consecutive years.

Worked in Singapore for a continuous period straddling two calendar years with a total period of stay of at least 183 days.

Been issued a work pass valid for a minimum of one year, which qualifies them as tax resident. However, when they end their employment, their tax residency status will be reassessed based on the standard tax residency rule. If their total stay in Singapore is under 183 days, they will then be considered as non-residents.

Tax residents are taxed on all income earned in Singapore. However, their foreign-sourced income brought into Singapore are tax-exempt, with some exceptions.

Non-residents, on the other hand, are taxed only on income earned in Singapore.

-

The amount of tax you pay in Singapore as an expat depends on various factors such as your income level, tax residency status, and the applicable tax rates. Singapore follows a progressive tax rate system, where higher income levels are subject to higher tax rates.

As an expat, if you are considered a tax resident of Singapore:

You will be taxed on all income earned in Singapore.

Your foreign-sourced income brought into Singapore is generally tax-exempt, with certain exceptions.

Non-residents, on the other hand, are taxed only on income derived from Singapore. Their employment income is taxed at either a flat rate of 15% or the progressive resident tax rate with personal reliefs, whichever yields a higher tax amount. Other types of income, like director’s fee, are generally taxed at a rate of 22%, which will increase to 24% from YA 2024.

It is recommended to consult with a tax advisor like Piloto Asia or refer to the guidelines provided by the Inland Revenue Authority of Singapore (IRAS) to determine your specific tax obligations and rates based on your circumstances.

-

Foreigners in Singapore can explore various tax-saving strategies to optimize their tax liabilities. Here are a few common methods:

Tax reliefs and deductions: Take advantage of available tax reliefs and deductions provided by the IRAS. These may include reliefs for specific expenses, such as medical expenses, education expenses, or donations to approved charitable organizations.

Double tax treaties: Determine if your home country has a double tax agreement with Singapore. These agreements are designed to prevent double taxation and provide provisions for tax credits or exemptions, depending on the specific terms of the treaty.

Central Provident Fund (CPF) contributions: As a foreigner, you may have the option to contribute to the CPF scheme, which provides retirement and healthcare benefits. These contributions can potentially lower your taxable income.

Structuring income and investments: Properly structuring your income and investments can help optimize your tax position. This may involve considering the use of tax-efficient investment vehicles, capital gains tax exemptions, or structuring business activities in a tax-efficient manner.

-

Yes, foreigners who are tax residents of Singapore are generally eligible for tax relief. Tax relief is provided by the Inland Revenue Authority of Singapore (IRAS) to help individuals reduce their tax liabilities. However, it's important to note that the availability and extent of tax relief may vary depending on factors such as the individual's tax residency status, employment type, and specific circumstances.

-

There are various types of tax relief available for foreigners in Singapore. Some common tax reliefs include:

Earned Income Relief: This relief is available to individuals who are employed or self-employed in Singapore. It allows for a deduction of a specific amount from the individual's taxable income.

Parenthood Tax Rebate: For individuals who are parents, this rebate provides tax relief for each qualifying child, helping to reduce the tax burden.

Course Fee Relief: Foreigners pursuing approved educational courses in Singapore may be eligible for course fee relief, allowing for a deduction of course fees from taxable income.

CPF Relief: Foreigners who contribute to the Central Provident Fund (CPF) may be eligible for CPF relief, which reduces their taxable income.

-

Yes, work permit holders in Singapore are generally required to pay income tax on their employment income earned in Singapore. Their tax liability is determined by their tax residency status and duration of stay.

Work permit holders with a permit valid for at least one year are initially treated as tax residents. However, their tax residency status will be reassessed upon the cessation of their employment. If their stay in Singapore totals less than 183 days by the time they resign, they will then be treated as non-residents.

If a work permit holder qualifies as a tax resident of Singapore, they will be taxed on their income earned in Singapore based on the country’s progressive tax rate system, where higher income levels are taxed at higher rates. However, non-residents, or those who stay in Singapore for less than 183 days in a calendar year, are taxed only on income derived from Singapore.

-

Yes! At Piloto Asia, we offer personalized accounting service in Singapore tailored to meet the needs of self-employed individuals like yourself.

Our dedicated team of tax professionals is here to guide you through every step of the personal income tax filing process. We will assist you in preparing preparing your tax returns, claiming tax deductions, and providing personalized tax planning advice to optimize your tax position.

As one of the reputable accounting service providers in Singapore, we aim to simplify your tax filing process and ensure compliance with all local tax regulations. Reach out to us today, and let’s make tax filing a breeze for you!

-

The income tax rates have stayed the same from 2017 to 2023 and only increased mainly for top earners from 20% to 22% and will go up to 24% starting next year.

-

Individuals are taxed based on income earned in Singapore.

-

The income tax rate in Singapore is considerably lower compared to other developed countries. For example, in Australia the highest personal income tax rate is 45%.

-

In view of the 2% increase from 2024, what impact will it have on resident taxpayers?

-

For monthly salary of $5k, the annual salary will be $60k. Based on the progressive tax rate, you will pay around $2k in tax.

-

You can qualify for reliefs and deductions if you are a tax resident staying in Singapore for more than 183 days.

-

Yes, as a self-employed individual, it is advisable to hire an accounting and auditing firm in Singapore to help you with your tax-related responsibilities. Accounting firms can help you with a variety of tasks related to your taxes, such as preparing your tax returns, calculating your tax liability, filing your taxes on time, and ensuring compliance with Singapore’s tax laws.

-

In Singapore, dividends from resident companies under the one-tier corporate tax system are generally not taxable. This also includes dividends received by resident individuals from foreign sources. However, foreign-source dividends are taxable if they are received or deemed to be received in Singapore, unless certain conditions are met. Singapore-sourced interest income, on the other hand, is taxable. As a result, most of the dividend income in Singapore is not taxable due to the country's tax incentives

Now, when relating to a holding company, what is a holding company? A holding company is a business entity whose primary purpose is to possess and control other companies' shares. They don't typically produce goods or services themselves. Rather, their purpose is to own shares of other companies, which can lead to various tax-related implications.

-

Singapore corporate tax does not directly affect personal income tax. However, it can indirectly impact personal income tax in several ways. For example, if a company pays less corporate tax, it may be able to pay its employees higher salaries, which would result in higher personal income tax for those employees.

-

ECI filing in Singapore is submitting an estimate of your company's taxable income for the upcoming year. The Inland Revenue Authority of Singapore (IRAS) uses the ECI to calculate the amount of corporate income tax that your company owes.

-

Individuals involved with holding companies in Singapore face unique personal income tax considerations. A key question they often have is 'what is a holding company' and how it affects their taxes. Essentially, a holding company owns shares in other companies and may distribute dividends to its shareholders. In Singapore, these dividends are typically exempt from personal income tax due to the one-tier corporate tax system. However, other forms of income from the holding company, like salaries or director's fees, are subject to the standard personal income tax rates. Understanding the financial structure and tax implications of a holding company is crucial for individuals to accurately manage their tax responsibilities.

-

Singapore's tax system is designed with a focus on fairness, progressiveness, and encouragement for investment and entrepreneurship. Here are some key highlights:

Not All Income is Taxable: Singapore does not tax capital gains or inheritances. Additionally, certain types of foreign income, when remitted to Singapore, are also tax-exempt. This approach helps to attract global talent and investment, fostering a more vibrant economy.

Progressive Tax Rates Favor Middle-Income Earners: Singapore's progressive tax rates are structured to be favorable to middle-income earners, ensuring a fair distribution of tax burden across different income groups.

Encouragement for Angel Investors: The Angel Investors Tax Deduction Scheme (AITD) was an initiative to encourage individuals to invest in startup companies, offering tax deductions for approved angel investors. Although the scheme has lapsed after 31 March 2020, it highlights Singapore's commitment to fostering an environment conducive to growth and innovation.

Special Considerations for Not Ordinarily Residents (NOR): The NOR scheme provided tax benefits such as time apportionment of employment income and tax exemption on employer contributions to overseas pension funds. This scheme, applicable until the Year of Assessment (YA) 2024 for those who qualified, underscores Singapore's efforts to attract and retain global talent by offering tax incentives.

Use of Technology in Tax Filing: Singapore has embraced technology in tax administration. The Auto Inclusion Scheme (AIS) for employers automates the inclusion of employment income details in tax returns, simplifying the filing process.

-

The income tax rate for foreigners in Singapore depends on their tax residency status. Non-residents are taxed at a flat rate of 15% on employment income. Other types of income, such as director's fees, are taxed at 22%, which will increase to 24% from the Year of Assessment (YA) 2024. However, if you qualify as a tax resident, you will be subject to the same progressive tax rates as Singapore citizens.

-

Tax residency for foreigners in Singapore is primarily determined by the length of your stay or work in the country. The key criteria are as follows:

Standard Rule: You are considered a tax resident if you reside or work in Singapore for at least 183 days in a calendar year. This status affects your tax rate, as tax residents are subject to progressive tax rates, while non-tax residents are taxed at a flat rate.

Consecutive Three-Year Period: As a concession, if you stay or work in Singapore for a consecutive period spanning three calendar years (not necessarily complete years), you are considered a tax resident for that duration.

Continuous Period Over Two Calendar Years: If you enter Singapore on or after 1 January 2007 and stay or work for a continuous period of at least 183 days spanning two calendar years, you will be considered a tax resident for those two years, regardless of whether your stay in each year is less than 183 days.

Tax Rates for Non-Residents: For non-tax residents, the income tax rate for Year of Assessment (YA) 2024 and onwards is set at a flat rate of 24% for income that is not from employment. Employment income for non-residents is taxed at a flat rate of 15% or the progressive resident rates, whichever results in a higher tax amount.

Understanding these criteria is crucial for foreigners in Singapore to determine their tax residency status and the applicable tax rates.

-

As Singapore’s top corporate service provider and business information resource, Piloto Asia is well-positioned to provide you with top-notch bookkeeping services Singapore-based; specifically structured to cater to the needs of self-employed professionals. With our expertise, you can focus on growing your business while we handle the meticulous task of recording your financial transactions, preparing your financial statements and offering advice based on your financial records. Additionally, our services extend to assisting with personal income tax filing, ensuring you have accurately calculated all deductions and exemptions, thus helping to streamline the process, avoid late filing penalties and maintain a clean tax record.

-

The cost of setting up a company in Singapore varies depending on the service provider you choose and the specific requirements of your business. At Piloto Asia, Singapore's #1 corporate service provider, we pride ourselves on being transparent about our fees. The initial cost to set up a Private Limited Company with us typically starts from SGD$800 to SGD$1500. For more detailed information, please visit our pricing page or get in touch with our dedicated team.

However, remember that how much it costs to set up a Private Limited Company isn’t the only important question. Quality, efficiency, trust in your provider and a wealth of expert knowledge are all integral considerations when embarking on your business journey. At Piloto Asia, we are proud to provide all these and more.